India…massive country with 1.3 billion population which doesn’t have government insured health service options unlike established western countries like Canada, Australia, New Zealand. Public healthcare system in India, is overloaded and all tertiary care institutions are concentrated in urban areas only. India spends only 3.5% of GDP on healthcare and we stand at 159th rank amongst 187countries in health expenditure criteria as per 2019 report 1, 2. The best healthcare service providercountries spend 10 or more than 10% of GDP on healthcare. We unfortunately stand at bottom 30 amongst healthcare expenditure data.

In such scenario, here citizens have to be responsible for their own health expenses. They might belucky if they get tertiary hospital care, but these hospitals, majority of times are overloaded. Thereis always huge waiting list for surgeries, treatments and sometimes, hospitals are not well equippedwith good equipment and advanced technologies. In the private sector, there is immediateassistance with good infrastructure but all these facilities come with huge cost. We have economic disparity at large level. At times, people don’t have money to pay Rs.500 per day for ICU charges at government hospitals. This is really pity! It is commendable thing that Ayushmann Bharat scheme, is now trying to fill the gap and people below poverty line are getting access to the needed healthcare services, free of cost at designated hospitals.

But since majority of people come in category of self-expenditure, having a health insurance, is not only helpful but also has become a necessity. 67.78% healthcare expenditure in India is from citizen’s own pocket against world average of 18.2% as per ‘out of pocket’ expenditure data of WHO’s health financing profile of 2017.

Government employees and few corporate sector organizations do give health insurance coverage to it’s employees. But that’s only 34% of total population3. This coverage is also not lifelong, it is limited to your job tenure. So, what about post-retirement health expenditure?? What about unforeseen circumstances wherein one becomes jobless (like pandemic or economic recession? Or bad management at organization.) What will be contingency planning in case of emergency and unforeseen scenarios?? The only answer is ” Health Insurance”. That’s gold standard solution since decades, but unfortunately, this is still viewed as dead investment. It is not….as it is investment done to avoid death bed…how can it be dead investment?? Afterall,” Jaan hai to Jahan hai”.

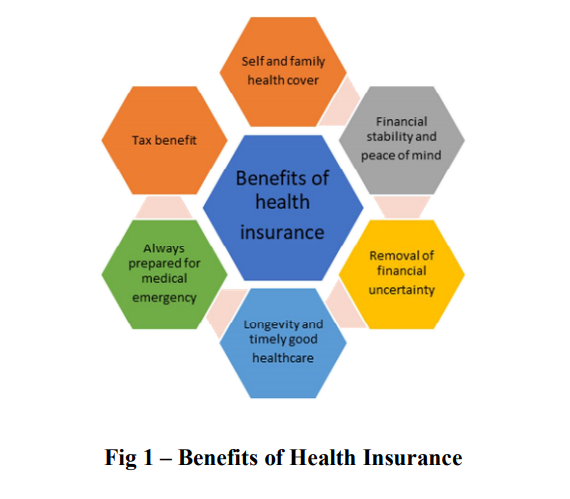

Benefits of having health insurance –

- It offers better and timely health cover for you and ensured family members without added finacial burden.

- You can comfortably handle any medical emergency and that won’t hamper your financial stability.

- Rising cost of healthcare will not cause any stress and tension of added economic burden as you are always prepared for it, ensuring longevity.

- Almost all health insurance premiums now give benefit of tax saving under section 80 D up to Rs. 1 lakh which is over and above Rs. 1.5 lakhs exemption under section 80C.

Now let us look at various options available for buying a health insurance. There is plethora of options.

General criteria for selecting a healthcare insurance provider should be –

1. What’s the claim settlement ratio?

2. Do they have top up option available if your insured amount is exhausted?

3. Do they have bonus option in case of no claim in particular year?

4. Do they have family floater options?

5. What is the waiting period for existing illness?? Do they cover pre and post hospitalization expenses and ambulance charges?

6. Do they cover pregnancy and delivery charges?

7. Do they cover day care procedures without requiring 24-hour hospitalization?? Do they cover OPD expenses?

8. Do they cover home care or domiciliary medical expenses?

9. Do they cover rehabilitation and training program charges?

10. Do they have cashless facility??

11. What’s the premium payment period? Will it cover tenure beyond premium duration as well? (There are few service providers who offer this option)

12. What’s the maximum age till which insurance cover is available? Of course, more is better but premium will increase accordingly but that’s worth consideration.

Health Insurance taken; what next?

So, after thorough research, suppose you buy health insurance, will that make you tension free? In a way, yes, of course. But responsibility, doesn’t end here. You need to be equally cautious at the time of claim settlement. Most of the times, we come across stories of hospitals charging bills exorbitantly, especially when there is health insurance coverage. Remember, your health insurance sum is for entire year, so if it gets exhausted in one hospitalization course and in unfortunate scenario, if you or other family members need hospitalization again, you will have added burden of expenses. So, check your hospital bill, break up wise thoroughly. Ask them for an itemized bill for each and every head. Also compare it with hospital’s routine tariff. Few hospitals have different tariff for insurance coverage (which is legally not correct). Give your consent for insurance coverage only after your thorough cross checking.

Know your rights – Approach consumer court for wrongful rejection –

Your role and cautiousness don’t end here. You need to be equally cautious at the time of claim approval from your insurance provider. We see many rejections for the genuine claims because either paper work is incomplete or insurance provider wrongly consider your illness as old illness and reject it on the pretext of existing disease and waiting period is yet to be over. Remember that you always have right to approach to consumer court against wrongful rejected claims.

For example, I read one case of wrongful rejection.

The particular insurance provider had rejected claim of an individual for Myocardial infarct and subsequently angioplasty related expenses. They had cited reason of existing illness of hypertension (high blood pressure). It was of course wrongful rejection. The petitioner challenged it in the consumer court. The verdict came in favor of that individual because Hypertension can not necessarily cause Myocardial Infarct or Coronary Artery Disease. It is one of the risk factors, but there are additional risk factors as well. Court also observed that people without Hypertension or Diabetes also have had heart disease. Finally, insurance provider had to approve the claim.

Conclusion –

Having good health insurance plan is necessity for everybody in India, of course for affordable class of people. For unaffordable class of citizens, they don’t have any choice but to rely on government run public healthcare facilities. But with insurance coverage, one can opt for private healthcare options and that way, it will reduce burden of public healthcare facilities and poor and needy people will have access to public healthcare facilities, with less waiting period. So, in a way, you actually act like responsible citizen.

Investment in health insurance should be viewed as necessity as it will cover your health risk for entire tenure, without causing financial burden. I would rather say, buy less gold, but buy one good 4 health insurance plan. That’s a worth investment and return on investment (ROI) is always your

financial freedom from healthcare expenditure and stress-free life ahead. Isn’t it??

Reference –

- data.worldbank.org, apps.who.int/nha/database

- CIA world fact book 2019

- National Health Profile 2018

- ALLERGY, ASTHMA AND SPORTS …. - August 17, 2020

- KNOW ABOUT ALLERGIES - July 27, 2020

- Health Insurance – Do we really need it? - July 17, 2020

Please wait...

Please wait...